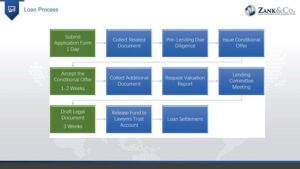

Zank Loan Approval Process

- After submitting the application form, the broker needs to provide some relevant documents required for the loan. ZANK will issue a conditional offer to the borrower after completing some preliminary due diligence.

- Borrowers need to supplement more required documents within one to two weeks of accepting the conditional offer provided by ZANK, including a valuation report and some supporting documents.

- After confirming that the loan is available, ZANK will prepare legal documents. Once both parties have signed the documents, the loan will be placed in the lawyer’s trust account and wait for delivery. This process takes about 3 weeks to complete.